Why We Consider Regal Belongings as the Best Gold IRA Company? A lot of the precious metals firms will take more than 30 days to deliver and in some cases, they even attain up to 90 days. Unlike 401(ok)s, that are primarily (though not always) sponsored by employers, nearly any grownup can open and start funding an IRA. Costs can go up and down based on provide, demand, and economic components. Market fluctuations can affect the worth of your precious metals investments. You may also combine in different burgundy blooms equivalent to dahlias, peonies, or carnations for added texture and depth. Whether or not you select to use burgundy flowers as the muse, add golden accents for elegance, combine textures for visual delight, or embody unique parts beyond flowers, this coloration combination is bound to make a press release. Mums additionally come in varied shapes and sizes, permitting you to create completely different textures inside your bouquets. Roses are a traditional selection for any wedding bouquet, and so they come in a variety of colors to suit any theme. The Bill, if handed, will help small companies and high-income earners come on the same footing and never favor high-revenue earners to unfairly use the loophole. Frontier Communications pulled the sector to small losses as it declined 2% to $4.88.

Simplified worker pension (SEP) IRAs are designed for self-employed individuals and small enterprise owners who have few (or no) employees. For brides who need their burgundy and gold wedding bouquets to make an announcement, dahlias are a really perfect alternative. This transfer course of is usually confused with a rollover, however it’s much more simple and comes with fewer IRS penalties and tax implications. Cellphone company stocks were the one sector in the standard & Poor’s 500 index to trade decrease. They’ve a construct a secured connection and computerized system the place purchasers don’t have handy sign any documents. From our analysis and reviews made by many skilled and shoppers, it clearly shows that Regal Assets is the best gold IRA company the place you’ll be able to have a peace of thoughts by selecting them as your gold backed IRA custodian.

Working with a reputable custodian can assist handle these costs. Sure, you may hold physical valuable metals in an IRA. From our research and critiques made by many professional and shoppers, it clearly reveals that Regal Belongings is the best gold IRA company the place you can have a peace of mind by choosing them as your gold IRA custodian. Investors were willing to take a few more dangers than the day earlier than, but they remained cautious, and demand for bonds and valuable metals stayed high. Finally, mitigating dangers associated with physical gold and paper property and other physical belongings in an traditional or Roth self directed IRA is crucial. Lastly, Humana Gold Plus HMO docs are known for his or her collaboration and coordination efforts. This can be especially useful for patients who are managing chronic conditions and need ongoing medication management. Regal Assets supply their purchasers a flat administration fees of $100/year on all retirement accounts. This type of generous offers makes you save up to $500, the place they are going to be paying for all your charges in the primary year – administration payment, setup charges, delivery charges and also storage fees all are waived for the primary yr.

1) Many individuals have been taken in by the quick speaking account representative who’re only eying on one factor which is the fee out of your sale. These storage options may be pricey. The price of storage and insurance can impression your general returns. These critiques can present invaluable perception right into a doctor’s bedside method, communication abilities, and total quality of care. You may incorporate gold ribbons or metallic wires into the bouquet’s wrapping, including a contact of glamour to its overall presentation. Treasured metals can protect your financial savings from inflation. In conclusion, choosing the correct flowers to your burgundy and gold wedding bouquets is important for making a cohesive and visually appealing aesthetic. These unconventional components will make your bouquet stand out and reflect your personal style. Golden parts deliver an air of elegance and opulence to any floral arrangement. To be eligible, you’ll have to be an lively duty, reserve, retired member or partner of the US Armed Providers, have appropriate army identification, and be over the age of 18. For the purposes of this offer, the US Armed Companies consists of the Army, Marine Corps, Navy, Air Force, Coast Guard and Nationwide Guard.

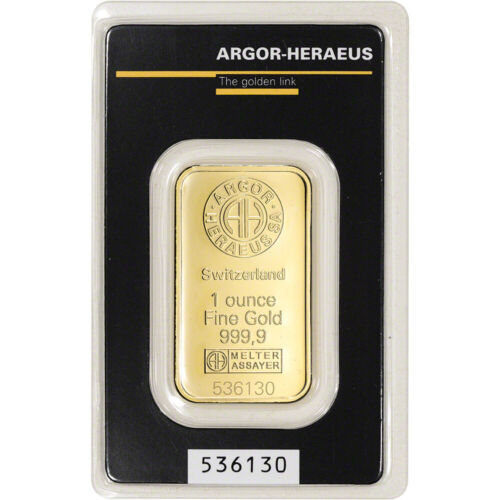

If it’s worthwhile to urgently sell your silver and gold again to BGG, they’ll settle for it without charging you a penalty. What to Search for When Purchasing for Gold IRA Companies? While these firms primarily use storage locations in America, most provide some international options in main cities across the globe, together with London, Dubai, and Zurich. With a commitment to helping buyers make wise choices, and by eliminating many of the additional costs that different companies charge, Monetary Gold permits customers to pay less for the same high-high quality precious metals they need for their desired IRA. Their platform could be very intuitive and permits users to rapidly understand how valuable metals and traditional IRA investments work. AHG permits you to buy precious steel coins and bars for money, however the minimal required funding is $5000. Like most IRAs, gold and treasured metals have required minimal distributions (RMD). They have useful customer support employees; they give account lifetime help to every buyer, they usually offer you probably the most methods to get in contact with them and get assist.

If it’s worthwhile to urgently sell your silver and gold again to BGG, they’ll settle for it without charging you a penalty. What to Search for When Purchasing for Gold IRA Companies? While these firms primarily use storage locations in America, most provide some international options in main cities across the globe, together with London, Dubai, and Zurich. With a commitment to helping buyers make wise choices, and by eliminating many of the additional costs that different companies charge, Monetary Gold permits customers to pay less for the same high-high quality precious metals they need for their desired IRA. Their platform could be very intuitive and permits users to rapidly understand how valuable metals and traditional IRA investments work. AHG permits you to buy precious steel coins and bars for money, however the minimal required funding is $5000. Like most IRAs, gold and treasured metals have required minimal distributions (RMD). They have useful customer support employees; they give account lifetime help to every buyer, they usually offer you probably the most methods to get in contact with them and get assist.

With all this knowledge obtainable on-line, you do not have to marvel what it could be prefer to work with Goldco Treasured Metals to get your gold IRA arrange. We respect your information – from our

With all this knowledge obtainable on-line, you do not have to marvel what it could be prefer to work with Goldco Treasured Metals to get your gold IRA arrange. We respect your information – from our